Indian pharma industry profitability improves as pricing environment eases: Equirus Capital

Trade generics and Jan Aushadhi are steadily gaining volume share from branded formulations, especially in price-sensitive acute therapies

CDMO – Return to growth and profitability

The CDMO segment’s revenue grew at an 8 per cent CAGR, driven by higher growth at Sai and Divis while Dishman continues to underperform. EBITDA margin up 1.2 per cent YoY; Dishman lagged due to French plant challenges while peers held steady.

Branded formulations – Persistent slowdown in volume growth

The revenue growth in the segment is largely driven by chronic therapies, field force expansion and new product additions. EBITDA margins grew steadily, which was majorly offset by higher promotional costs and field force costs. ROCEs declined marginally as companies pursue large acquisitions fueled by debt. Trade generics and Jan Aushadhi are steadily gaining volume share from branded formulations, especially in price-sensitive acute therapies. Branded pharma players are responding by shifting focus toward chronic therapies, speciality segments, and strengthening field force productivity. The Key high-profile acquisitions were:

- Mankind’s acquisition of BSV reflects a strategic shift to high-margin, specialty segments

- Eris acquired Biocon India’s branded formulations (insulins, oncology, critical care)

Generics – US Gx pricing pressure continues to dampen growth

Revenue growth decreased from 10.6 per cent in FY24 to 7.6 per cent in FY25 due to headwinds on account of US pricing pressure, geopolitical uncertainties and tender misses in key RoW markets. EBITDA margins improved due to favourable product mix, profitability gains in emerging markets and strong operational execution in regulated markets, partially offset by pricing pressure in the US. ROCE showed muted growth, majorly impacted by ongoing capacity expansions, and the underutilisation of newly invested greenfield facilities. R&D is being rationalised to prioritise high-value opportunities and monetise the existing ANDA pipeline over fresh filings. The Rs 5,000 crore PRIP scheme, by the Department of Pharmaceuticals, GoI, aims to catalyse Rs 17,000 crore in additional R&D investments, marking a shift from volume-based generics to innovation-led pharma growth. 24 mega-selling drugs with combined annual sales exceeding $250 billion will lose patent protection by 2030 and will soon be open for generic manufacturing.

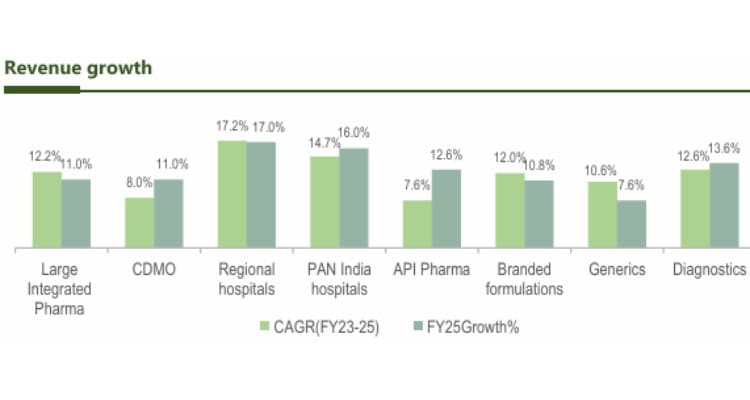

Healthcare Delivery and Diagnostics firms delivered better results while the generics and branded formulations industry continues to face headwinds, according to an analysis of the healthcare sector by leading investment bank Equirus Capital. The revenue growth posted by Healthcare Delivery and Diagnostics in FY25 were higher than CAGR from FY23-25.

Healthcare delivery and diagnostics have delivered better growth

The revenue growth in FY25 vs CAGR FY23-25 was – CDMO at 11 per cent vs 8 per cent, PAN India hospitals at 16 per cent vs 14.7 per cent, API Pharma at 12.6 per cent vs 7.6 per cent and Diagnostics at 13.6 per cent vs 12.6 per cent.

Large hospitals chains – Capex intensity to continue with aggressive M&A push

The ARPOB, or Average Revenue Per Occupied Bed, has fuelled a higher revenue growth at 16 per cent in FY25 vs 14.7 per cent in FY23-25. Sector-wide margins have improved, driven by higher occupancy rates & improvement in case mix. ROCE dipped marginally in FY25, attributed to ramp-up phase of greenfield additions. The sector debt levels rose due to aggressive expansion: Max Healthcare added INR 1,200-1,500 crore for new beds; Apollo invested INR 2,000 Cr+ in tier-2 cities, and Fortis secured INR 800 crore for upgrade. The sector-wide bed capacity grew 3 bps, as larger chains continue to ramp up capacity in Tier 2 and 3 towns and cities. Sector-wide capital expenditure increases, fuelled by increased M&A transactions and capacity expansion initiatives, including new hospital developments and bed additions at existing facilities.

Diagnostics – Pricing environment remains constrained, with growth driven by volumes

The sector witnessed higher growth driven by volumes as prices remained constrained. Margins expanded due to higher volumes, reduced lab processing and sample collection costs via automation, and increased hub utilisation. The sector’s ROCE growth was driven by improved asset utilisation (higher test volumes) and franchise-led expansion (capital-light growth). The sector’s capex declined as companies prioritised franchise-based and asset-light expansion strategies.

Companies are expanding diagnostic centres in Tier 2 and 3 cities to drive volume growth. Diagnostic pricing remains constrained due to discounting by online players. The higher footfalls per centre indicate volume push through higher franchise/ sample collection centres. The expansion of diagnostic centres, supported by PPP and franchise models, has enabled companies to enter low-footfall cities cost-effectively while benefiting from increased test volumes.