Funding declines in pharma as June sees 97% plunge

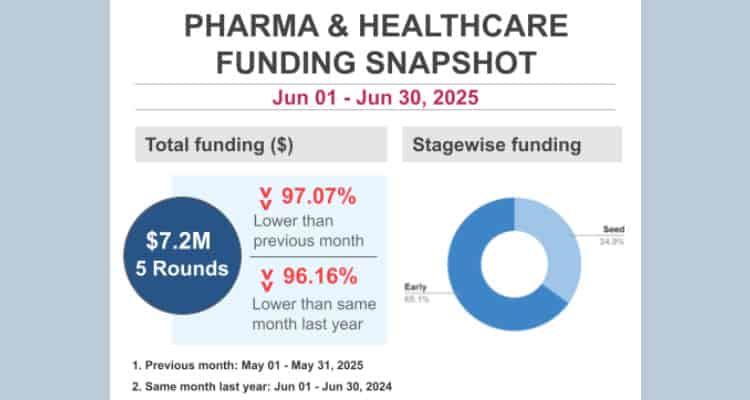

Total funding reached $7.2 million across 5 rounds, representing a 97.07 per cent decrease from May 2025

Key takeaways:

- Sharp decline in funding: Funding dramatically decreased in June 2025, falling over 97 per cent from the previous month and over 96 per cent from the same month last year.

- Early-stage rounds dominate: Unlike previous periods, early-stage investments

made up the largest share of funding in June at 65.1 per cent, surpassing seed-stage funding.

- No major outlier deals: The top deal in June was significantly smaller ($4.7 million) compared to the previous month’s top deal of $156 million, indicating a lack of large-scale funding rounds.

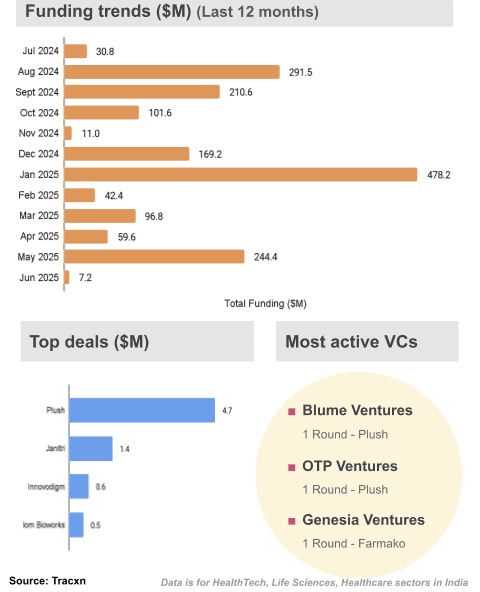

In June 2025, the pharma and healthcare ecosystem in India witnessed a significant slowdown in investment activity. Total funding reached $7.2 million across 5 rounds, representing a 97.07 per cent decrease from May 2025 and a 96.16 per cent decrease from June 2024.

June 2025 experienced a steep downturn, with total funding plummeting to just $7.2 million, while May 2025 saw a massive recovery in funding, with total funding reaching $244.4 million, a 310 per cent increase from April 2025 ($59.6 million).

Stage-wise funding trends:

- Early-stage rounds dominated the landscape, making up 65.1 per cent of the total capital deployed.

- Seed-stage financing accounted for the remaining 34.9 per cent, reaffirming sustained interest in nascent ventures despite overall funding contraction.

Top funding deals:

The most notable funding round in June was secured by Plush, which raised $4.7 million, accounting for the majority of capital injected that month, followed by Jantri at $1.4 million, Innovodigm at $0.6 million, and Iom Bioworks at $0.5 million.

Blume Ventures and OTP Ventures each participated in one funding round for Plush. Genesia Ventures backed one funding round for Farmako.