Strategic procurement in clinical trials: A digital transformation imperative

Gourab Ray, Global Category Buyer, Sanofi outlines key value levers, describes an operating model that integrates procurement with clinical and supply-chain functions, and proposes a pragmatic roadmap for sponsors and CROs seeking to modernise their approach

Clinical trial procurement is moving from a narrow, transactional “buying” function to a strategic capability that shapes speed, cost, quality and patient access. Rising protocol complexity, decentralised and hybrid trial models, supply-chain shocks and intensifying regulatory expectations mean sponsors can no longer treat procurement as a back-office activity. At the same time, digital technologies — advanced analytics, AI/ML, RPA, digital twins, and integrated e-procurement platforms — are creating new ways to plan, source and manage critical services and supplies.

This article argues that strategic, digitally enabled procurement has become a core differentiator in clinical development. It outlines key value levers, describes an operating model that integrates procurement with clinical and supply chain functions, and proposes a pragmatic roadmap for sponsors and CROs seeking to modernise their approach.

The changing economics of clinical trials

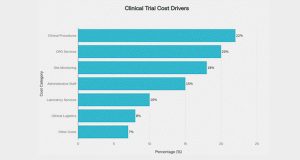

Across geographies and phases, the economics of clinical trials are dominated by a small set of cost drivers. Analyses of US trial budgets consistently show that clinical procedure costs, administrative staff, and site monitoring together account for a large share of total spend, often in the range of 35- 60 per cent depending on phase and design[1][2].

Figure 1 illustrates the major cost categories that dominate clinical trial budgets.

These cost drivers are heavily influenced by decisions that procurement can shape:

- Which CROs and vendors are selected, and on what commercial model.

- How comparator drugs, ancillaries, devices and logistics services are sourced and contracted. ● How risk is shared (or not) across multi-country, multiyear studies. At the same time, global sponsors are grappling with:

- More complex and adaptive protocols.

- Growth in decentralised and hybrid trial models.

- Increased focus on diversity, equity and inclusion in recruitment.

- Heightened regulatory scrutiny of data integrity, temperature control, and supply continuity.

In markets like South Asia and India, industry observers expect 2026-2027 and beyond to bring a further surge in early-phase research, more decentralised trials and deeper reliance on digital tools for patient recruitment and operational oversight[15]. Against this backdrop, a purely transactional approach to procurement — focused on unit price and contract execution — is no longer sufficient.

From transactional buying to strategic clinical procurement

Historically, clinical trial procurement was often fragmented:

- Study teams ran one-off RFQs via email and spreadsheets.

- Category strategies for CROs, labs, depots, packaging or home-healthcare were weak or absent.

- Data on supplier performance, change orders and passthrough costs was scattered across systems.

Strategic procurement in clinical development looks very different. It is characterised by:

- Category management and supplier segmentation: Dedicated category strategies for CRO services, central labs, eCOA/ePRO, clinical logistics, packaging and labelling, homecare vendors, technology platforms and specialist consulting[13][14]. Key suppliers are treated as long-term partners, not just bidders in episodic tenders.

- Value-driven relationships instead of pure price competition: Commercial models increasingly combine base fees with performance-linked elements tied to start-up timelines, recruitment, data quality or audit outcomes[11]. Structured business reviews and joint improvement roadmaps replace purely transactional interactions.

- Integrated quality and compliance thinking: ICHGCP, data integrity and GDP requirements are built into category strategies and contracts rather than addressed ad hoc at the site or study level. Procurement works with QA, pharmacovigilance and regulatory teams to ensure vendors can withstand inspection and scale with the portfolio.

- Early involvement in protocol and operational design: When procurement is brought into discussions before protocols are finalised, it can surface feasibility, comparator access, depot strategy and packaging concerns that materially influence timelines and cost of goods[12].

This shift mirrors developments in purchasing and supply-management more broadly, where AI/ML, data and integrated platforms are turning procurement into a strategic business partner[8][14].

The digital imperative: new tools for an old problem

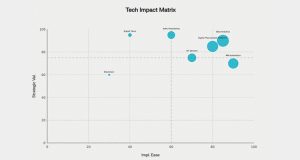

Digital transformation in clinical trial procurement is not about adopting “shiny” tools; it is about creating better, faster and more resilient decisions across the study lifecycle. Chart 1 presents the strategic positioning of key technologies based on implementation ease and strategic value. Several technology layers are now maturing:

Data foundations and analytics Many sponsors still struggle with basic questions:

- What is our true spend on CROs, labs, depots and logistics across the portfolio?

- How often do we trigger costly urgent resupplies or protocol-driven rework?

- Which suppliers consistently hit or miss key milestones? Modern analytics platforms, fed from CTMS, eTMF, ERP, e-sourcing tools and AP systems, allow procurement to build an integrated view of:

- Study-level and categorylevel spend.

- Change orders and scope creep.

- Cycle times (e.g. start-up, contract execution, site activation).

- Supplier performance and quality signals.

In parallel, biopharma companies are starting to use AI and ML to predict site performance, enrollment trajectories and operational risks, enabling earlier interventions and more realistic supply plans[3][4]

AI/ML for forecasting and scenario planning

AI/ML techniques are increasingly used in clinical development to:

- Predict enrollment based on historical data and real-world evidence.

- Optimise site selection and country mix.

- Flag potential bottlenecks in monitoring, data cleaning or logistics. For procurement, this translates into better demand signals for comparators, IMP and ancillaries, as well as more robust scenarios for:

- Depot placement and capacity.

- Packaging batch sizes and overage levels.

- Safety stock thresholds for temperature-sensitive supplies.

This is where digital twin concepts become powerful[6][7]. A clinical supply digital twin creates a virtual model of the trial supply chain, allowing teams to simulate and compare different sourcing and logistics strategies before implementing them in the real world.

RPA and workflow automation

While AI tackles complex prediction problems, robotic process automation (RPA) is quietly attacking the “paperwork mountain” that surrounds clinical procurement:

- Automating invoice capture and matching for high-volume vendors.

- Creating and routing purchase orders from approved budgets.

- Extracting key data from contracts and amendments into structured fields.

- Updating status dashboards and alerts.

RPA has already shown value in pharma finance and R&D operations, reducing manual effort and error rates while improving process consistency[9][10]. Applied to procure-to-pay, it frees specialists to focus on negotiations, risk management and stakeholder engagement rather than data entry.

Digital procurement platforms and SRM

E-sourcing, e-contracting and supplier relationship management (SRM) tools are mainstream in many industries, and adoption in pharma is accelerating[13]. For clinical procurement, these platforms enable:

- Structured, transparent RFx processes with standard templates.

- Centralised storage of contracts with version control and audit trails.

- Systematic supplier onboarding, qualification and risk scoring.

- A shared view of obligations, rebates and performance metrics.

External industry commentary increasingly emphasises the role of procurement as a driver of digital innovation in pharma, particularly in building digital supplier ecosystems and using data to manage risk and foster co-innovation[14].

Emerging technologies: digital twins, IoT and blockchain

IoT-enabled sensors and control towers now provide near real-time visibility of temperature, location and dwell time across depots and lanes, improving compliance and reducing write-offs[6].

Digital twin approaches are being piloted not only for manufacturing but also for end-toend supply-chain design, stress-testing networks against disruptions and policy changes[7]. Blockchain-based solutions for drug traceability and anticounterfeiting are under active exploration; while not mandated by regulators, they can complement existing serialisation and data-integrity controls. Operating model: making digital and strategic stick Tools alone do not transform procurement. Organisations that get this right typically rethink their operating model along four dimensions.

Centre-led, hybrid structures

Global surveys show that many mature organisations gravitate towards centre-led or hybrid procurement models, blending a small central team responsible for strategy and standards with empowered local teams closer to studies and sites[11][12].

In clinical procurement, this often means:

- A central category team for CROs, labs, logistics, packaging and DCT vendors.

- Regional or BU-level teams embedded with clinical operations, accountable for tactical execution within global frameworks.

- Governance forums that include clinical, medical, quality and finance stakeholders, not just procurement.

This structure allows sponsors to leverage scale and standardisation where it matters, without losing the agility needed for country-specific requirements and investigator relationships.

Integrated governance with R&D and quality

Strategic clinical procurement is tightly connected to:

- R&D portfolio governance — to align sourcing strategies with pipeline priorities.

- Clinical operations — to ensure vendor choices support recruitment, diversity and patient-centric design[5]

- Quality and pharmacovigilance — to embed inspection readiness and data-integrity concerns from the outset. Joint steering committees, shared KPIs and integrated risk registers help prevent the “hand-offs” that have historically plagued complex programmes.

Skills and culture

Digital and strategic procurement require a different skill mix from traditional buying:

- Data-literate category managers able to interpret analytics, scenario outputs and AI insights.

- People comfortable leading cross-functional negotiations on risk-sharing, innovation and performance metrics.

- Familiarity with regulatory expectations specific to clinical trials and GxP environments. Research on AI in purchasing and operations emphasises that benefits are realised only when organisations invest in skills and change management, not just tooling[8].

Supplier collaboration and innovation

Finally, strategic procurement builds collaborative innovation networks with CROs and niche providers:

- Shared dashboards on performance, risk and improvement initiatives.

- Co-designed pilots on decentralised models, remote monitoring or novel logistics solutions.

- Carefully structured agreements for co-development and data sharing where appropriate.

The goal is not to outsource responsibility, but to co-create better ways of running trials[14].

A practical roadmap for sponsors and CROs

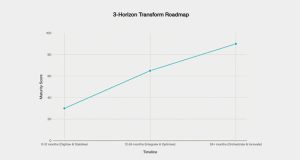

Every organisation starts from a different baseline, but a simple three-horizon roadmap can help. Chart 2 illustrates the progressive maturity trajectory across these horizons.

Horizon 1 (0-12 months): Digitise and stabilise

- Map current spend, suppliers and tools across clinical categories.

- Standardise RFx templates, basic scorecards and contract clauses for key risk areas (e.g. data integrity, temperature excursions, business continuity).

- Implement or stabilise core e-sourcing/CLM and basic analytics, with at least a consolidated view of category and supplier spend.

- Identify “quick-win” RPA use cases in procure-to-pay (invoice processing, PO creation, data extraction)[9][10]

Horizon 2 (12-24 months): Integrate and optimise

- Connect procurement tools with CTMS, IRT and finance systems to improve forecast accuracy and visibility.

- Introduce predictive analytics for enrollment and supply planning and begin using scenario analyses in sourcing decisions[3][4]

- Pilot a centre-led operating model for one or two categories (e.g. CRO and logistics), with global frameworks and local draw-down.

- Formalise supplier performance management and QBRs with your most critical partners.

Horizon 3 (24+ months): Orchestrate and innovate

- Develop digital twin pilots for complex, multi-country studies to de-risk depot networks, overage strategies and sourcing options[6][7]

- Expand AI/ML use cases beyond forecasting to contract analytics, risk-sensing and proactive issue detection.

- Explore blockchain-based traceability where it meaningfully complements existing serialisation and GDP controls.

- Embed digital and strategic procurement KPIs into R&D scorecards — not just cost savings, but impact on cycle time, recruitment, deviations and audit findings.

Procurement as a lever for smarter, faster, more resilient trials

As the clinical trials ecosystem becomes more competitive and more digital, procurement is no longer a support function sitting in the background. It directly influences:

- Speed — through smarter supplier choices, better forecasting and streamlined contracting.

- Cost and productivity — by controlling key cost drivers and reducing waste from rework, change orders and write-offs.

- Quality and compliance — by ensuring that vendors, data and physical flows meet the expectations of regulators and patients.

- Resilience — by diversifying supply options, modelling scenarios and leveraging real-time visibility.

For sponsors and CROs that embrace a strategic, digitally enabled procurement model, the prize is not only lower unit prices, but better clinical outcomes, more predictable timelines and a stronger competitive position in an increasingly demanding global environment.