India’s innovation journey: From promise to proof

India’s pharma ecosystem is ready to embrace stronger science and bolder ideas. Turning early breakthroughs into scalable, sustainable innovation remains the challenge

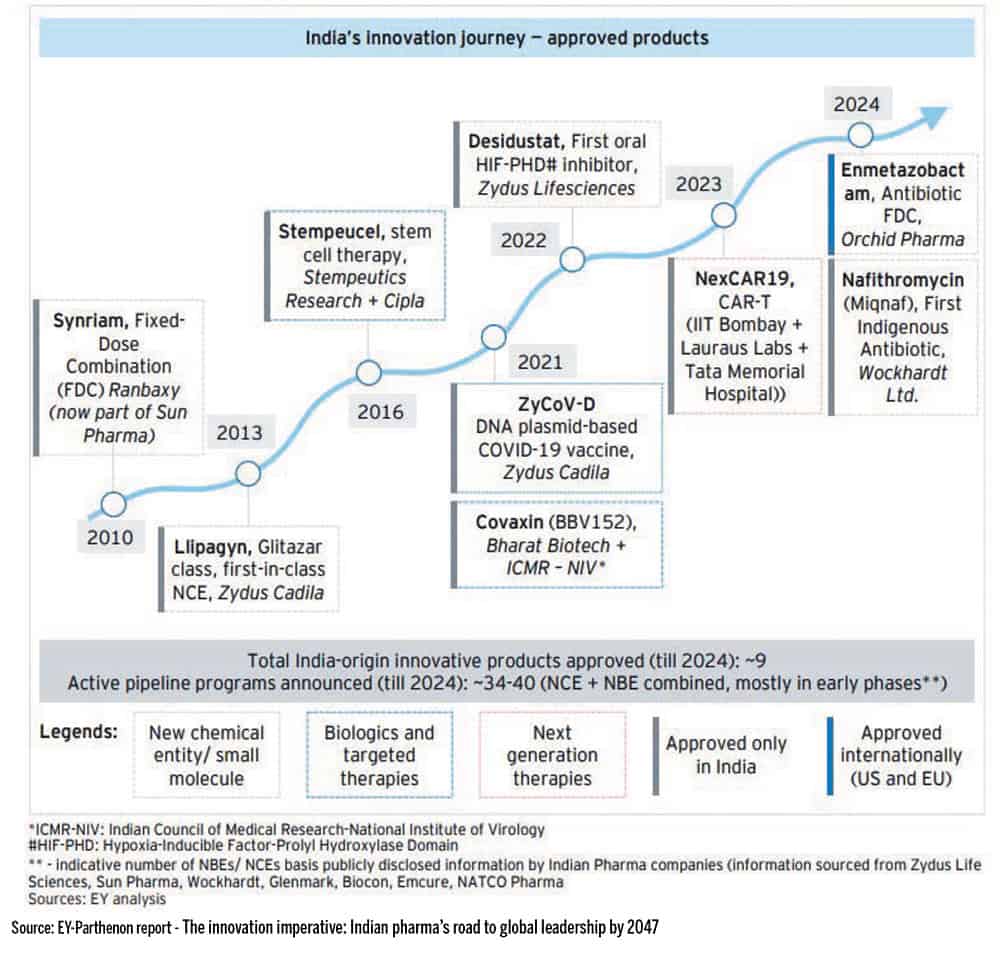

India’s pharma industry’s global reputation has been built on scale. Affordable generics, dependable vaccines, and world-class manufacturing. That foundation remains strong. But as India aspires to become a $30–35 trillion economy by 2047, the expectations from pharma are changing.

Scale alone will no longer be enough. The next phase must be driven by innovation, value creation and science-led leadership. (Read:https://www.expresspharma.in/innovationmade-in-india/).

While India has many of the ingredients required for innovation, several structural bottlenecks continue to slow progress. This article, Part II of our series on India’s innovation journey, focuses on those bottlenecks. The next part will explore the strategies that could help India move from promise to proof. However, before examining what is holding India back, it is important to recognise how far the ecosystem has already come.

The promise

India’s bottom of the innovation pyramid is well built. Startups are emerging. Academic science is strong. Incubators and early grants are more accessible than before.

In a recent report titled, ‘The innovation imperative: Indian pharma’s road to global leadership by 2047’, Suresh Subramanian, National Life Sciences Leader, EY-Parthenon highlights, “Multinational innovators are increasingly outsourcing early research, development, analytics and manufacturing. Indian CRDMOs are moving up the value chain by investing in advanced modalities, digital QA/QC and integrated development pathways. This shift positions India not just as a manufacturing destination but as a strategic partner in complex, science-led innovation, underlining the momentum behind CRDMO/CDMO sector’s growth in India.”

He also points out, “Nearly half of the world’s leading life sciences companies now run GCCs in India, capitalising on deep scientific talent and strong digital capabilities. These centers have evolved from efficiency-focused units into global innovation hubs that support drug discovery, trial optimisation, digital therapeutics, safety analytics, regulatory operations and enterprise-wide transformation. These trends reinforce the growing maturity of India’s life sciences ecosystem.”

Dr Priya Kapoor G Hingorani, MD, Miltenyi India and VP– South East Asia, also notes, “India is known globally for its talent. With over 80 incubators, ATAL Innovation Centres, DBT–BIRAC supported bio foundries, and strong academic hubs, the country produces high-quality science at scale.”

The paradox

Clearly, India’s innovation ecosystem has matured over the past decade. The country has a deep pool of scientific talent, a growing network of incubators, public funding platforms and academic institutions that are increasingly open to translational research.

Early-stage innovation is no longer the weak link. Support from institutions such as BIRAC, C-CAMP and THSTI has created a strong foundation for startups and translational research and improved access to funding, laboratories and mentorship. And yet, innovation outcomes remain uneven. Breakthrough ideas emerge, but too few make it all the way to scalable, globally competitive therapies.

As Dr Sundaram Acharya, JSPS Postdoctoral Fellow, University of Tokyo, puts it, “India doesn’t suffer from a talent deficit. It suffers from a riskcapital and risk-appetite deficit.” His work, enFnCas9, country’s first indigenously developed CRISPR genome editing platform with a granted US patent, received the DHR–ICMR Health Research Excellence Award 2025 (Gold). The team developed engineered, kinetically enhanced, high-precision FnCas9 (enFnCas9) variants which were conceived, built and validated entirely in India.

This is the paradox at the heart of Indian pharma innovation. India can generate ideas, but struggles to consistently scale them into globally competitive therapies. While Indian pharma companies have steadily improved R&D capabilities, spending levels remain well below global peers. Especially in high-risk areas such as biologics and cell and gene therapies.

The country has science and ambition, yet hesitation and risk-averseness still prevents it from backing bold, long-term bets.

That hesitation, however, is not without reason. Innovationled drug development demands long timelines, high upfront investment, and acceptance that not every programme will succeed. In contrast, India’s pharma success has historically been built on efficiency, predictability and speed to market. Bridging this mindset gap will be one of the industry’s most difficult transitions.

Taking bigger innovation bets

Industry conversations increasingly point to one underlying issue. India’s innovation challenge is no longer about intent, but about environment. There are positive policy changes, and innovation features prominently in strategic discussions. But the ecosystem is still not fully designed to support risk-taking at scale. Funding cycles remain short, regulatory pathways lack clarity, and there are access gaps to advanced infrastructure.

Dr Acharya explains this gap clearly, and says, “To take bigger innovation bets, we now need three shifts. He elaborates: Non-dilutive early capital for deep-tech: Grants in India are too small and too fragmented. A young team can’t build a genome editing platform or a new therapeutic modality on ?50–75 lakh. We need at least ~$1million equivalent catalytic grants that let teams pursue bold ideas without immediately optimising for revenue.

Technical infrastructure that doesn’t require reinventing the wheel: Shared core facilities, GMP-adjacent pilot labs, and rapid regulatory pathways would cut development cycles by years. A culture that rewards originality rather than incrementalism: Too many young scientists are trained to avoid failure. Bigger bets require institutional protection for people who push boundaries and occasionally break things.

Thus, it is clear that innovation at scale demands patience. It also demands systems that allow failure, long development timelines, and uncertainty without reputational or commercial penalties. These conditions are still evolving across India’s pharma ecosystem.

Collaboration matters

Building such an environment is not the responsibility of any single stakeholder. This is where collaboration becomes central to India’s innovation journey. As the EY-Parthenon report highlights, “Achieving the value-driven transformation will require more than isolated corporate initiatives; it demands the creation of a robust ecosystem that nurtures research, rewards risk-taking and synergistically connects all elements of the ecosystem.”

It adds, “The ability to realise India’s vision of becoming a global pharma powerhouse hinges on collaborative efforts across all stakeholders in the ecosystem: global and domestic pharma companies, CRDMOs, GCCs, government, regulators, academia, hospitals, private investors and start-ups. Each segment is evolving to excel in its domain, but now is the time to converge, align priorities and act cohesively to achieve the nation’s ambition of emerging as a global leader in pharma and healthcare innovation.”

Dr Hingorani also underlines the importance of stronger PPPs and says, “Public–private collaboration enables global players such as Miltenyi Biotec to bring endto-end CGT workflows, helping Indian innovators de-risk development, accelerate timelines, and deliver patient-centric therapies that can meet both Indian and global regulatory expectations.”

India already has several government-led initiatives that support early-stage innovation. What is needed now is deeper engagement from industry and global players. We need to bring translational expertise, operational excellence, and global benchmarks into the ecosystem.

Public and private players should work together to make innovation faster, manage risks better, and ensure predictable outcomes.

Regulatory clarity: A key imperative

India’s regulatory environment has matured, but predictability remains uneven, particularly for early-phase innovation. Industry experts stress that partnerships depend on clarity. Early-stage research flows to ecosystems where regulatory pathways are transparent and timelines predictable.

Innovation does not need diluted standards. It needs agile, science-led regulation that enables early experimentation without compromising safety

The hardest challenge: Integration

Advanced therapies introduce a new level of complexity that the ecosystem is still learning to manage. According to Dr Hingorani, “The harder challenge lies in building an integrated cell and gene therapy (CGT) ecosystem, especially across various elements in the value chain while keeping patient outcomes at the centre.”

Cell and gene therapies demand early coordination across manufacturing, quality systems, supply chains, clinical design, and access planning. Unlike traditional development models, these elements cannot be layered in sequentially.

In India, however, these components often come together too late. This makes scale-up slower, riskier and more expensive.

The missing middle

A persistent bottleneck in India’s innovation journey is the gap between discovery and scale, the so-called missing middle. The ecosystem falters at the stage where science must be translated into scalable, regulatory-ready products.

This stage demands manufacturing discipline, efficient quality systems, robust supply chains, and strong clinical intent. When these considerations are not built in early, projects face delays, redesigns and rising costs later.

Experts explains why this transition is so fragile and point out Translating promising science into therapies that are scalable, reproducible, consistent, reliable, affordable, and regulatory-ready requires early alignment of manufacturing discipline, quality systems, supply chain robustness, clinical intent and access models. The issue here is not scientific capability. It is systemic gaps.

Risk and predictability

Funding and laboratory access in India have improved significantly over the years. Yet founders working on deep-science innovation still face uncertainty, particularly as projects move into longer, capital-intensive phases.

For Acharya, predictability is as critical as capital. He asserts, “To accelerate the upward curve, founders need predictability and patience, clear regulatory pathways, continuity of support, and encouragement to build for global markets from India, not just local ones.”

Dr Hingorani views are similar, “India has successfully built the foundation through sustained public funding, regulatory strengthening, and infrastructure creation. To accelerate the upward curve, founders need predictability and patience, clear regulatory pathways, continuity of support, and encouragement to build for global markets from India, not just local ones. Miltenyi Biotec sees its role as supporting this transition by working with institutions such as BIRAC and THSTI, and by contributing technical experience to the evolving regulatory and manufacturing landscape for cell and gene therapies in India.”

Predictability across policy, regulation and funding gives innovators the confidence to build ambitious platforms rather than incremental solutions. Without it, even the most promising science struggles to survive the long journey to market.

Why these challenges matter

These bottlenecks come at a moment of real opportunity for Indian pharma. Global pharma value chains are being reconfigured. Companies are actively seeking reliable, innovation-capable partners. Advanced manufacturing, digital tools and data-driven discovery are reshaping how medicines are developed.

At this stage, industry leaders argue that incremental change will not be enough.

“The sector must move beyond short-term volume gains and cost efficiencies to invest in next-gen therapies, digital transformation, regulatory agility and a robust talent pipeline. To sustain and accelerate this journey, every stakeholder—industry, government, academia, investors and startups—must converge and act cohesively. Strong public-private alliances, purposeful digital integration and ecosystem-wide investment in R&D are essential to building a future-ready healthcare sector that serves India and the world,” opines Anil Matai, Director General, OPPI, in the EY-Partnenon report.

As Suresh Subramanium also notes, “The shift from volume to value marks a profound transition that demands bold thinking, sustained investment and collective ambition. As the boundaries between science and technology blur, India’s success will depend on how effectively the ecosystem converges – linking academia and industry, global and local partners, established players and emerging innovations, and deep science and digital technology.”

India has scale, talent and a growing digital backbone. What it still needs is alignment between capital and science, regulation and risk, ambition and execution.

If these gaps are not addressed now, India risks remaining just a secondary player in innovation-led value creation. As Subramanium from EY Parthenon asserts in the report, “The time to act is now. India’s aspiration to become the world’s innovation engine is within reach – but it will take courage to invest, trust to collaborate and vision to lead collectively.”

What comes next

What is holding India back are limited risk appetite, underinvestment in scale-up, weak integration across the value chain, and a lack of predictability for founders.

India’s pharma ecosystem is no longer asking whether it can innovate. The real question is whether it can build the systems needed to scale innovation consistently and sustainably. That answer will shape not just the future of Indian pharma, but India’s role in global healthcare over the coming decades.

As Dr Acharya puts it, “Ultimately, India’s global leadership will come from recognising a simple truth. More people means more problems but also more brains, more perspectives, and more original ideas. If we align capital, institutions, and risk appetite to harness this collective intelligence, India will not just participate in the global innovation ecosystem, it will reshape how innovation itself is done.